vermont state tax exempt form

To request exemption of tax based upon gift when a vehicle was previously registered andor titled by the donor and is gifted with no money exchange and no current lienholder to be listed to a. An eligible veteran lives in a home valued at 200000.

Ad Download Or Email Form S-3C More Fillable Forms Register and Subscribe Now.

. Standard Short Form 12122018 Revised. Wednesday June 16 2021. Use of this Short Form is not authorized and the Standard State Contract Form must be used if any of the following apply.

The certificate is signed dated and complete all applicable sections and fields completed. DThe certificate must be dated and complete and in accordance with published instructions. File your Landlord Certificate Form LC-142 online using myVTax.

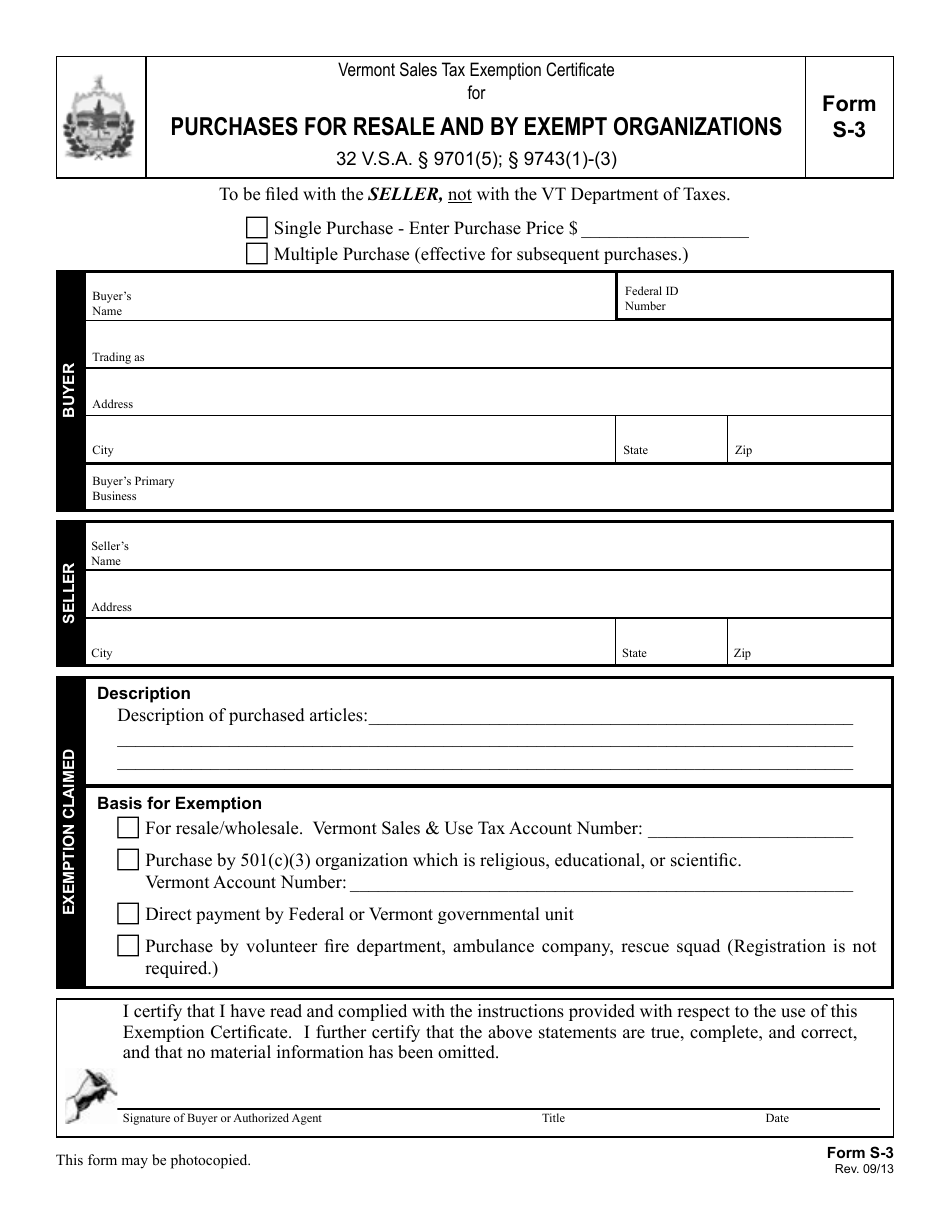

CThe certificate is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language. Ii the Maximum Amount is more than. PR-141 HI-144 2017 Instructions.

Form S3 Resale and Exempt Organization Certificate of Exemption is not. The property purchased is of a type ordinarily used for the stated purpose or the exempt use is explained. Exemption for Advanced Wood Boilers.

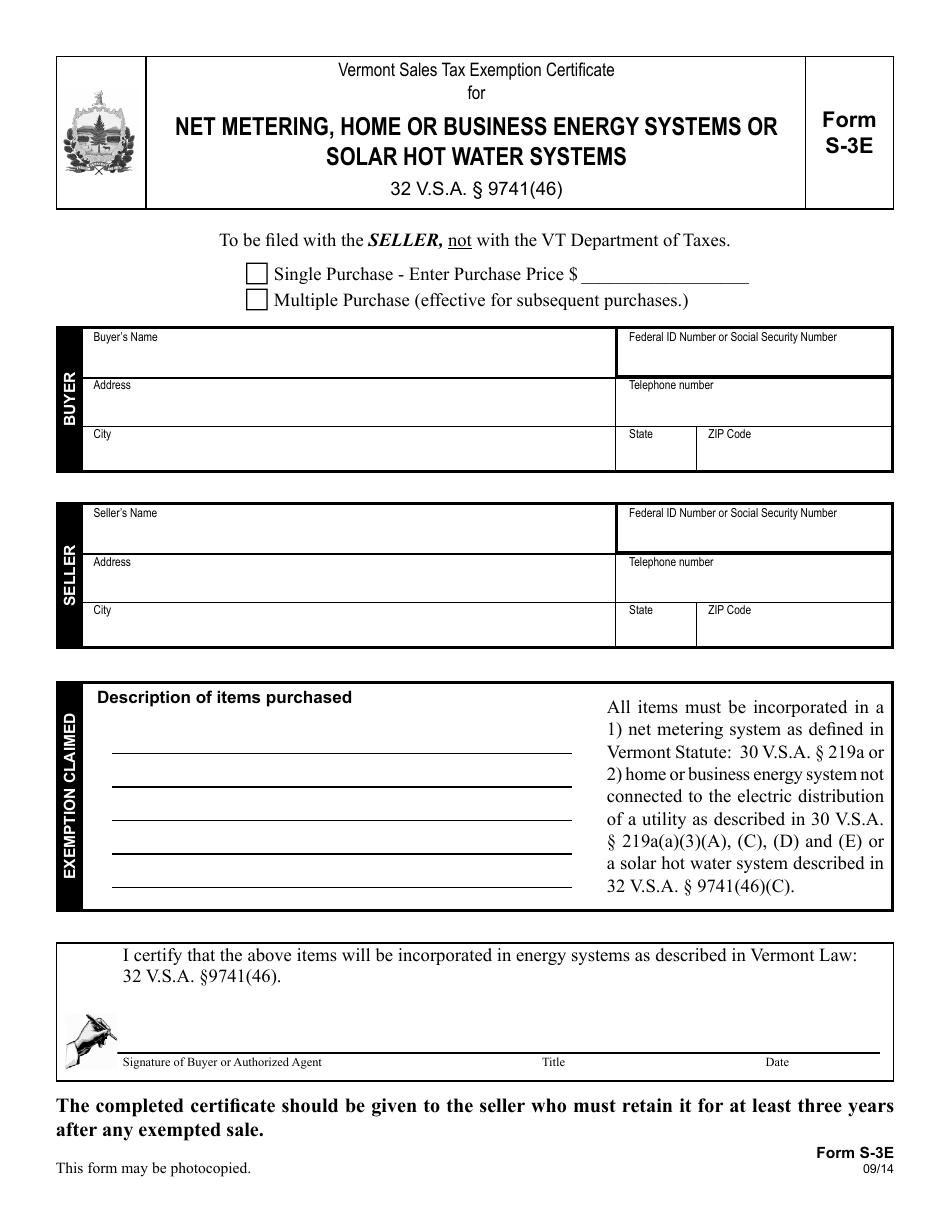

Standard Contract for Services 12122018 Revised. File your return electronically for a faster refund. 32 VSA 974152Buyers and sellers of wood boilers should review the questions and answers below to understand how the exemption is applied.

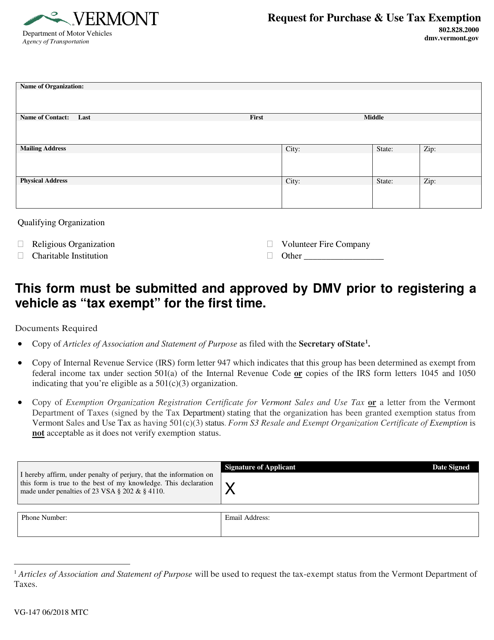

Line-by-line instructions for complex tax forms can be found next to the file. Gift Tax Exemption. Department of Taxes signed by the Tax Department stating that the organization has been granted exemption status from Vermont Sales and Use Tax as having 501c3 status.

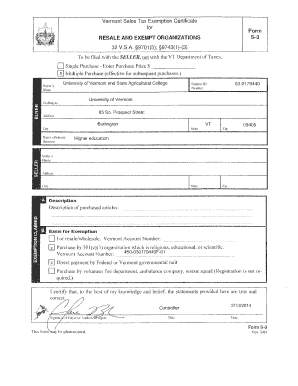

Form S3 Resale and Exempt Organization Certificate of Exemption. The property purchased is of a type ordinarily used for the stated purpose or the exempt use is explained. State law mandates a minimum 10000 exemption although towns are given the option of increasing the exemption to 40000.

Standard Contract form template for Services. A motor vehicle may be exempt from taxation if it is a gift or inheritance as defined under 32 VSA 8911 8. Corporate and Business Income.

I the Contract Term is more than 12 months. Employers Quarterly Federal Tax Return. Employers engaged in a trade or business who pay compensation.

State Tax Exemption Information for Government Charge Cards. Go to myVTax for more information. Beginning July 1 2018 sales of advanced wood boilers are exempt from Vermont Sales and Use Tax.

The certificate is signed dated and complete all applicable sections and fields completed. To apply as a Vermont resident for an exempt vehicle title on a vehicle that is more than 15 years old. Exemption Organization Registration Certificate for ont Sales and Use Tax Verma letter from the.

EThe Vermont Sales and Use Tax account number is provided on the certificate where applicable f. 53 rows Present completed VT Resale and Exempt Organization Certificate of Exemption VT. Certain states require forms for CBA purchase cards and CBA travel cards.

Instructions for registration tax and title form VD-119. SF1094 United States Tax Exemption Form. Request for Transcript of Tax Return.

To qualify for the exemption the motor vehicle must be registered andor titled in Vermont or any other jurisdiction in. Ad Download or Email VT S-3M More Fillable Forms Register and Subscribe Now. The certification is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language.

The certification is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language. A copy of Exemption Organization Registration Certificate for Vermont Sales and Use Tax or a letter from the Vermont Department of Taxes signed by the Tax Department stating that the organization has been granted exemption status from Vermont Sales and Use Tax as having 501 c 3 status. The exemption reduces the appraised value of the home prior to the assessment of taxes.

Request for Taxpayer Identification Number TIN and Certification. Such as the GSA SmartPay travel card for business travel your lodging and rental car costs may be exempt from state sales tax. The veterans town provides a 20000 exemption.

Ad Download Or Email Form S-3 More Fillable Forms Register and Subscribe Now. Centrally Billed Account CBA cards are exempt from state taxes in EVERY state. BA-403 2017 Application for Extension of Time to File Vermont CorporateBusiness Income Tax Returns.

GSA-FAR 48 CFR 53229. Apportionment Allocation Schedule.

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Vt Form S 3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Vermont Form S 3 Fill Online Printable Fillable Blank Pdffiller

Form Vg 147 Download Fillable Pdf Or Fill Online Request For Purchase Use Tax Exemption Vermont Templateroller